Stock Ticker: MSFT (Microsoft Corporation)

Even amidst a robust bull market, caution signals are emerging in the US equity markets as we progress through 2026. Recent developments in key sectors like AI and commodities are indicating potential pullbacks and market corrections.

Challenges Ahead for AI Stocks

Microsoft (NASDAQ:MSFT), a prominent player in the AI sector, faced a significant setback despite surpassing Wall Street estimates. The stock witnessed its largest single-session drop since March 2020, driven by concerns over increased CAPEX spending on AI data centers. With a 66% year-over-year rise in expenses and other operational challenges, such as a slowdown in its cloud business, Microsoft’s performance is setting a cautious tone for AI stocks and the broader market in the near term.

Silver Market Warning Signs

The silver market is showing signs of a potential “blow-off top,” reminiscent of historical scenarios that led to significant market downturns. Factors such as record trading volume, substantial deviation from the 200-day moving average, and exhaustion gaps are signaling a possible reversal in the silver bull market. Past instances, like the Hunt Brothers’ market cornering attempt in the 1980s, suggest that such developments could trigger a 10% decline in the S&P 500 in the coming weeks.

February Seasonality Trends

Despite positive factors like record tax returns and a supportive Federal Reserve stance, historical trends indicate potential market corrections in February. Ryan Detrick from Carson Research highlights February as one of the historically negative months for stock performance, emphasizing the need for caution during this period.

Image Source: Carson Research

Assessing Investor Sentiment

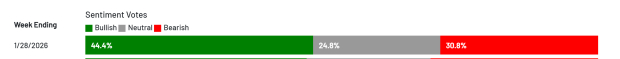

The AAII Sentiment survey reveals a prevailing bullish sentiment among individual investors, indicating a potential contrarian signal for market participants to exercise caution and consider the broader market context.

Image Source: Zacks Investment Research

Market Outlook and Conclusion

While the long-term outlook for 2026 remains positive, with the AI revolution and accommodative monetary policy, current market signals suggest a period of consolidation may be imminent. Investors are advised to monitor key indicators closely and prepare for potential market adjustments in the near term.

This article originally published on Zacks Investment Research (zacks.com).