Generative AI in the fintech industry is revolutionizing financial operations, offering solutions for personalized financial services, fraud detection, risk management, automation, and operational efficiency. With examples like Airwallex’s “KYC Copilot” and Revolut’s Scam Detection, Gen AI is reshaping the finance sector.

From enhancing data-driven decision-making to providing tailored customer experiences, improving credit scoring accuracy, and ensuring strong security measures, the benefits of generative AI in fintech are vast. Implementing Gen AI is crucial for financial institutions looking to stay competitive in the market.

This article explores the transformative use cases of generative AI in fintech, highlighting key benefits, real-world examples, implementation strategies, challenges, and future trends in the industry. It delves into how Gen AI is influencing fintech, offering insights for developing Gen AI-powered solutions for financial institutions.

Key Takeaways

- Generative AI in fintech streamlines financial operations through personalization, fraud detection, risk management, and more.

- The benefits of generative AI in fintech include improved personalization, fraud detection, risk assessment, customer service, automation, and compliance.

- Top uses of Gen AI in fintech are hyper-personalized financial solutions, advanced fraud detection, robust risk management, intelligent automation, and operational efficiency.

- Real-world leaders utilizing AI in fintech are Revolut, Airwallex, OCBC Bank, among others.

- The future of fintech is moving towards autonomous finance, AI copilots, synthetic data, and invisible banking experiences.

Generative AI in FinTech: Market Overview

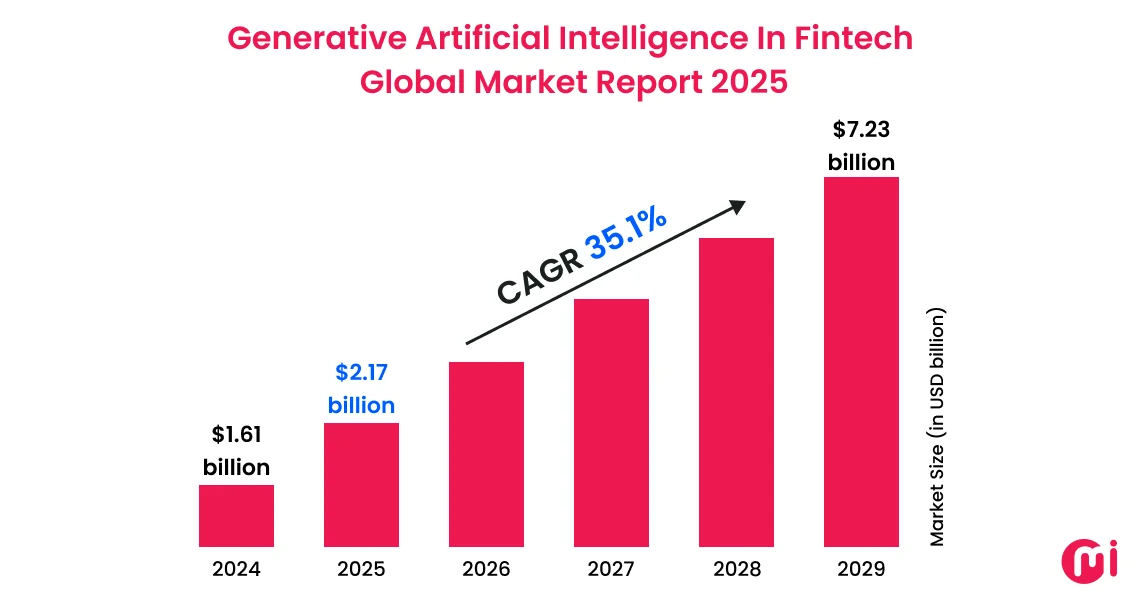

Generative AI adoption in the fintech sector is projected to grow significantly, reaching $7.23 billion by 2029. This growth is driven by the demand for personalized financial services, AI-powered fraud detection, and compliance solutions.

This forecasted growth in generative AI adoption in fintech is driven by advancements in personalized financial services, AI-based fraud detection, and the increasing need for efficient compliance solutions in the financial sector.

The significant trends in generative AI in fintech include the integration of AI with blockchain technology, AI-powered trading algorithms, AI-enabled personal financial management tools, and more.

The innovation of AI for credit scoring and lending will play a crucial role in the implementation of Gen AI in the fintech sector.

Benefits of Generative AI in FinTech

Generative AI in fintech offers numerous benefits to financial institutions, including accelerated data-driven decision-making, enhanced security, hyper-personalized customer experiences, operational efficiency, improved credit scoring accuracy, and more. Here’s a closer look at the advantages of Gen AI in fintech:

Accelerated Data-Driven Decision Making

Generative AI in fintech aids in wealth management advisory, lending decisions, and investment planning by analyzing complex financial data and providing actionable insights. It can identify market trends, predict outcomes, and offer scenario-based recommendations faster than human analysts.

Stronger Security and Risk Reduction

With real-time anomaly detection, Gen AI can identify suspicious behavior patterns and evolving fraud tactics, such as unusual transaction locations or abnormal spending spikes, faster than traditional systems. This leads to significant reductions in financial losses and ensures compliance with regulations.

Hyper-Personalized Customer Experiences

Gen AI enables hyper-personalized customer experiences by analyzing financial behavior, spending habits, and investment patterns to provide tailored financial guidance and product suggestions. This customization enhances customer satisfaction and loyalty.

Greater Operational Efficiency and Lower Costs

Back-office tasks like underwriting, claims processing, client onboarding, and document verification can be automated with Gen AI-powered fintech solutions, reducing processing time and improving productivity.

Improved Credit Scoring Accuracy

By utilizing generative AI in fintech solutions, financial institutions can assess traditional and alternative data sources accurately, leading to more reliable credit decisions.

Streamlined Regulatory Compliance & Reporting

Generative AI simplifies regulatory compliance and reporting by assisting with audits, automating KYC/AML checks, generating risk reports, ensuring policy adherence, and maintaining audit-ready documentation.

Superior Customer Service

Gen AI-powered fintech solutions, like conversational AI agents, offer 24/7 customer support, resolve queries instantly, and streamline customer assistance, enhancing satisfaction levels.

Top 5 Transformative Use Cases of Generative AI in FinTech

Generative AI has a significant impact on various industries, including fintech. The top use cases of Gen AI in fintech include hyper-personalized financial solutions, advanced fraud detection, robust risk management, intelligent automation, and operational efficiency.

Here’s a look at how Gen AI is reshaping banking and finance in different ways:

| GenAI Use Cases in FinTech | Why It’s Important |

| Hyper-Personalization of Financial Services | Enables customized financial products, advisory, credit recommendations, and personal budgeting using GenAI insights. |

| Advanced Fraud Detection & Risk Management | Detects anomalies, predicts risk in real time, reduces false positives, and improves compliance accuracy. |

| Intelligent Automation & Operational Efficiency | Automates financial documentation, underwriting, claims processing, reporting, and back-office tasks. |

| AI-Powered Conversational Customer Service | AI chatbots and voice assistants deliver human-like financial support 24/7 and reduce call center load. |

| Algorithmic Trading & Market Analysis | Predictive AI models generate trading signals, market insights, simulations, and risk-adjusted investment strategies. |

1. Hyper-Personalization of Financial Services

Generative AI in fintech analyzes customer data, spending habits, and financial goals to offer tailored recommendations like customized investment strategies and loan offers. This level of analysis provides a bespoke customer experience, increasing engagement and loyalty.

The failure to leverage the immense potential of generative AI in your marketing strategy isn’t just an oversight — it’s a regret that AI will be happy to tell you that you made later.

— Kevin Farley, VP of Experience and Engagement, United Heritage Credit Union

2. Advanced Fraud Detection and Risk Management

Generative AI-powered fintech solutions enhance security by analyzing large volumes of transactional and behavioral data in real time to identify anomalies and detect suspicious activities more effectively than traditional systems.

For instance, PayPal uses Gen AI to reduce its fraud loss rate by almost 50% over three years, adapting in real-time to evolving threats and enhancing customer protection.

3. Intelligent Automation and Operational Efficiency

Gen AI-powered fintech solutions streamline operations by automating back-office tasks like document processing, report generation, and data entry, reducing manual errors and improving productivity.

OCBC Bank’s internal generative AI assistant automates tasks for its employees, reducing time spent on various activities by 50%.

4. AI-Powered Conversational Customer Service

Generative AI-driven chatbots and virtual assistants provide 24/7 customer support, handling inquiries and resolving issues efficiently through natural language processing. These intelligent agents enhance the customer experience by accessing context and offering relevant assistance.

Bank of America’s “Erica” virtual assistant has handled millions of client queries, providing personalized guidance to customers.

5. Algorithmic Trading and Market Analysis

Generative AI plays a vital role in investment firms by processing vast datasets, including financial news and social media sentiment, to predict market movements and generate data-driven trading strategies. This technology optimizes portfolio management and balances risk for maximum returns.

Real World Examples of Generative AI in FinTech

Real-world applications of generative AI in fintech include Revolut’s scam detection and Airwallex’s AI-powered “KYC copilot, revolutionizing the fintech sector:

Revolut’s Scam Detection

Revolut uses generative AI-powered fraud detection models to identify suspicious transactions and protect users from scams and unauthorized activities, resulting in a 30% reduction in fraud losses.

Airwallex’s AI-Powered “KYC Copilot

Airwallex employs large language models to accelerate its KYC assessment process, reducing false positives by 50% and enhancing due diligence.

How to Implement Generative AI in FinTech

Implementing generative AI in fintech requires a structured approach that prioritizes strategy, data readiness, governance, and phased implementation. Here’s a guide to implementing Gen AI in fintech:

1. Defining Business Needs and Goals

Identify specific challenges where generative AI can add value, such as improving operational efficiency, enhancing customer experience, or mitigating risks. Start with a high-impact pilot project to validate outcomes and ROI.

2. Assessing and Preparing Your Data Landscape

Evaluate and prepare data sources to ensure they are clean, accurate, and accessible for generative AI models. Implement data governance and encryption to maintain security and compliance.

3. Building a Qualified Team & Involving Stakeholders Early

Hire AI developers, data scientists, and domain experts to form a cross-functional team. Engage stakeholders early to align with organizational needs and regulatory requirements.

4. Selecting the Right Gen AI Tools and Platforms

Choose foundation models that align with your use case, considering factors like performance, cost, and scalability. Select solutions that meet your needs for successful Gen AI implementation.

5. Developing a Strategic Implementation Plan

Create a detailed roadmap for deployment, including timelines, milestones, and KPIs to measure success at each phase.

6. Piloting, Testing, and Iteration

Deploy the solution in a controlled pilot environment, monitor performance, and conduct continuous testing. Use human-in-the-loop review for high-stakes decisions to mitigate risks.

7. Scaling Gradually and Evolving

Expand the generative AI solution based on the pilot’s success and learnings. Foster a culture of continuous learning to stay competitive in the evolving AI domain.

Challenges of Generative AI in FinTech and Their Solutions

While generative AI offers immense potential, its adoption in financial ecosystems poses challenges that institutions must navigate carefully. Here are the challenges and solutions when implementing generative AI in fintech:

Data Privacy, Security & Compliance Concerns

Generative AI in fintech works with sensitive financial information, requiring robust data protection and regulatory compliance measures to prevent data exposure and unauthorized access.

Solution: Implement secure data governance frameworks, advanced encryption techniques, and privacy-preserving models to align with financial