The predicted growth of the wealth management software market is substantial, with estimates projecting it to reach $26.98 billion by 2035, showcasing a CAGR of 12.76%. This growth is attributed to the numerous benefits and advantages these systems offer.

Wealth management solutions provide a wide array of features, including financial planning, data management, goal management, risk management, and more.

From making data-driven investment decisions to offering personalized solutions, enhancing customer experience, saving costs, increasing productivity, improving security, and more, wealth management software brings a host of benefits to wealth managers.

By leveraging these benefits, these systems assist wealth management firms in providing personalization, real-time insights, and seamless digital experiences to their clients.

This blog post serves as a detailed guide to the development of wealth management software, covering its purpose, market landscape, types, features, benefits, development process, costs, challenges, and future trends.

It aims to provide comprehensive information to make the process of developing FinTech IT solutions for wealth management more accessible and understandable.

This is a rewritten article discussing the predicted growth and benefits of wealth management software, along with a detailed guide to its development process, costs, challenges, and future trends. It aims to provide valuable insights for developing FinTech IT solutions for wealth management.

Key Takeaways

- Wealth management software is a digital solution designed specifically to help banks, financial advisors, and investment firms manage clients’ wealth more effectively.

- Many types of wealth management solutions involve portfolio management software, financial planning software, investor portals, investment platforms, client lifecycle management systems, and more.

- Most important features of wealth management software include financial data management, financial planning & goal management, risk management & investment strategy, and AI/ML-powered intelligence.

- Software for wealth management benefits organizations with data-driven investment decisions, personalized solutions, improved customer experience, cost savings, and more.

- The future-ready wealth management software platforms will be shaped by AI advisory, personalization, open banking, and ESG investing.

What Is Wealth Management Software?

Wealth management software is a digital, cloud-based solution designed to assist financial advisors, banks, and investment firms in managing client wealth more effectively.

It consolidates portfolio tracking & management, financial planning, risk assessment, reporting, compliance, and client communication into a single and personalized platform.

A wealth management software centralizes data from various sources and enables investment analysis, performance reporting, secure client portals, and data-driven insights to support complex financial strategies for clients.

Unlike basic financial tools, a wealth management solution supports long-term financial planning, investment strategy execution, and ongoing client engagement.

It acts as both an operational backbone for financial advisors and a transparency tool for clients, enabling informed decision-making and trust-based relationships.

The Purpose of Wealth Management Software Development

The primary aim of wealth management software development is to modernize and optimize wealth management across organizations.

It assists financial advisors and institutions in efficiently managing client portfolios, automating complex tasks, gaining deep insights, and delivering personalized financial planning, improving client experience, ensuring compliance, and scaling operations.

Wealth management software aims to:

- Enhance operational efficiency through automation

- Enable personalized financial planning & investment strategies

- Improve transparency and client trust

- Support regulatory compliance and risk management

- Provide data-driven insights for better investment decisions

- Scale services without compromising quality

Wealth Management Software: Market Overview

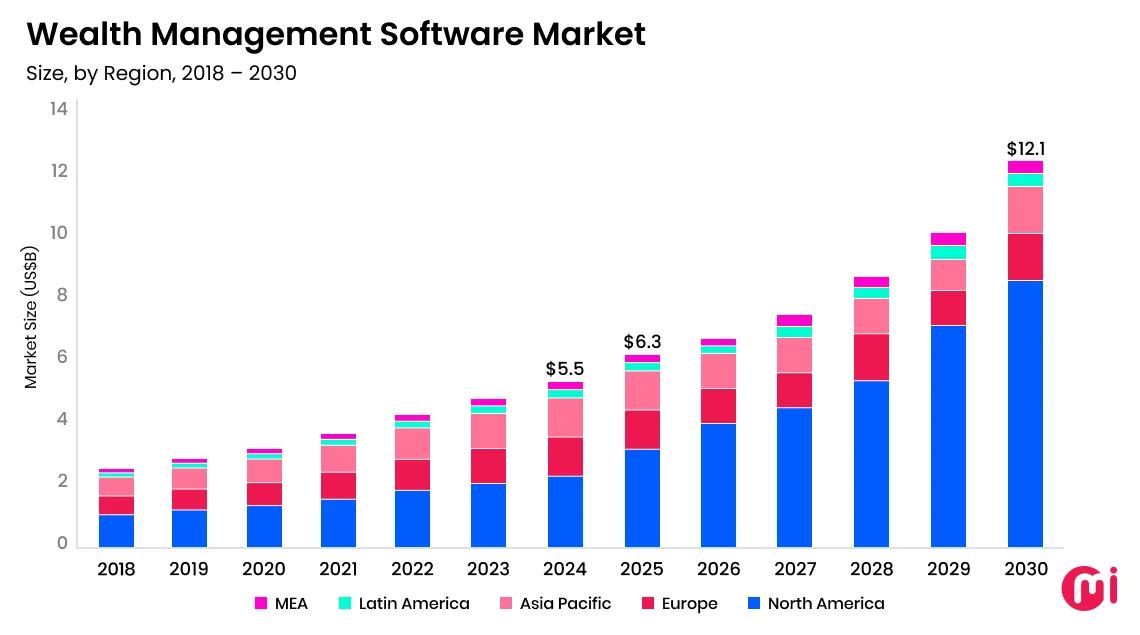

According to Grand View Research, the global wealth management software market size was estimated at $6.3 billion in 2025 and is projected to reach $12.07 billion by 2030. This growth would be at a CAGR of 14.0% from 2025 to 2030.

This market growth is attributed to the growing adoption of the latest technologies in wealth management advisory.

Traditional Vs. Modern Wealth Management Software

Traditional and modern wealth management software systems differ in various aspects, including data architecture, update frequency, reporting, integration, customer experience, personalization, scalability, compliance, and more. The table below highlights these differences in detail to help you distinguish between them and choose the right one:

| Feature | Traditional Wealth Management Solutions | Modern Wealth Management Solutions |

| Data Architecture | Siloed, on-premise databases with limited interoperability | Cloud-native, centralized, and API-driven data architecture |

| Update Frequency | Periodic batch updates and manual refresh cycles | Real-time or near real-time data synchronization |

| Reporting | Static, pre-defined reports with limited flexibility | Dynamic, customizable dashboards with advanced analytics |

| Integration | Limited integrations with rigid, legacy systems | Seamless third-party integrations via open APIs |

| Customer Experience | Advisor-centric with minimal client self-service | Client-centric, digital-first, and self-service enabled |

| Personalization | High-touch, relationship-based | Data-driven, algorithmic (can be supplemented) |

| Scalability | Scaling requires infrastructure upgrades and downtime | Designed to scale with cloud-native architecture. |

| Security | Perimeter-based security with limited real-time monitoring | Multi-layered security with continuous threat detection |

| Compliance | Manual compliance tracking and reporting | Automated compliance monitoring with audit-ready workflows |

| AI/Analytics | Basic historical analysis and rule-based logic | Predictive analytics, machine learning, and intelligent insights |

| Technology Stack | Legacy programming languages and monolithic systems | Microservices, cloud platforms, and modern frameworks |

| Development Time | Months to years for customizations | Faster development, iteration, and deployment |

| Development Cost | High long-term maintenance and upgrade costs | Optimized costs through modular, scalable architecture |

Types of Wealth Management Software Solutions

There are various types of wealth management solutions, including portfolio management software, financial planning software, investment platforms, investor portals, client lifecycle management systems, trading software, and more. Here’s how they transform wealth management, maximizing benefits for clients, financial advisors, and institutions:

Portfolio Management Software

Portfolio management software aids advisors in monitoring, analyzing, and optimizing client investment portfolios across various asset classes, including equities, fixed income, mutual funds, ETFs, and alternative investments.

These systems provide real-time or near real-time performance tracking, asset allocation insights, and portfolio rebalancing tools.

Advisors can evaluate portfolio performance against benchmarks, identify underperforming assets, and make data-driven adjustments aligned with client goals and risk tolerance. Moreover, advanced systems also support tax optimization and scenario-based portfolio modeling.

Financial Planning Software

Financial advisors utilize these solutions to deliver goal-based financial planning rather than product-centric advice.

These tools facilitate modeling long-term financial objectives such as retirement planning, education funding, estate planning, and wealth accumulation.

By running multiple “what-if” scenarios, advisors can assess the impact of market changes, life events, or investment decisions.

Visualizing future outcomes, financial planning software enhances transparency and helps clients understand the reasoning behind recommendations, strengthening trust and long-term relationships.

Investment Platforms

Investment platforms serve as the execution layer of wealth management operations, facilitating buying, selling, and managing financial instruments while integrating with trading systems, custodians, and market data providers.

These platforms streamline trade execution, settlement, and reconciliation processes. Additionally, they provide access to diversified investment products