Stock Ticker: Sandisk Corporation (SNDK)

Current Market Context: Sandisk Corporation (SNDK) has surged by a remarkable +70% in just 11 trading days this year, surpassing $400 per share. This rapid growth positions SNDK as a top contender in the tech stock market for 2026.

Sandisk Corporation (SNDK) has demonstrated an exceptional performance with its stock price skyrocketing to over $400 a share, marking a remarkable +70% increase in just 11 trading days this year. This surge solidifies SNDK as one of the hottest tech stocks to watch in 2026.

The impressive rally of Sandisk’s stock is not a random occurrence but a direct result of the scarcity in the memory chip market, particularly in the non-volatile flash memory segment known as NAND. As a major producer of NAND, Sandisk is reaping the benefits of this scarcity as the demand for high-performance flash storage in AI infrastructure continues to rise, driving NAND prices higher and propelling SNDK’s stock price.

Sandisk’s Strategic Positioning

Following its spinoff from Western Digital (WDC), Sandisk emerged as a focused, independent entity with a dedicated business in flash memory. The decision to split the business into HDDs and flash memory was based on the distinct market opportunities, growth trajectories, and capital requirements of each segment.

The industry-wide scarcity of NAND, essential for AI infrastructure and enterprise HDDs, has significantly boosted Sandisk’s stock performance, resulting in a remarkable +700% surge since becoming a standalone publicly traded company in February 2025. This growth trend has also positively impacted Western Digital, with its shares climbing over +300% during the same period.

Image Source: Zacks Investment Research

Understanding NAND Technology

NAND, a form of non-volatile flash memory, retains data even without power and serves as the foundation for modern storage devices. Widely used in SSDs, USB drives, smartphones, and other consumer electronics, NAND’s structure is based on the NOT-AND logic gate, determining data storage in memory cells.

Utilizing floating-gate transistors to capture electrons and represent data bits, NAND’s non-volatile nature, high density, speed, durability, and low power consumption make it ideal for consumer storage solutions. In the current AI and data-center expansion, NAND-based SSDs play a crucial role in feeding data to AI chips, GPUs, and other accelerators.

Financial Strength of Sandisk

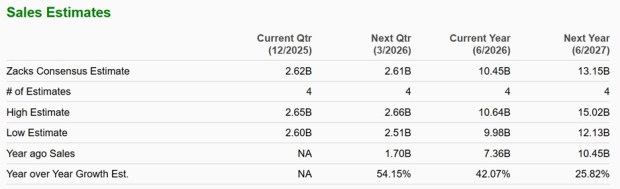

Sandisk stands out as a spinoff company that has immediately delivered value, showcasing robust financial performance uncommon for such entities. Projected sales for fiscal 2026 indicate a substantial 42% increase to $10.45 billion from $7.36 billion in the previous year, with further growth anticipated in FY27 to $13.15 billion.

Image Source: Zacks Investment Research

Earnings per share are forecasted to surge by an impressive 350% in FY26 to $13.46 from $2.99 in 2025, with a further 93% increase expected in FY27 to reach $25.94. Sandisk’s stock rally is underpinned by substantial EPS revisions, with estimates climbing over 100% in the last three months, reflecting the company’s strong growth trajectory.

Image Source: Zacks Investment Research

Valuation Analysis

Despite the substantial price appreciation, Sandisk remains reasonably valued with a forward earnings multiple of 30X. This valuation aligns closely with the industry average and Western Digital, indicating SNDK’s attractive positioning in the market.

Image Source: Zacks Investment Research

In Conclusion

Sandisk Corporation (SNDK) emerges as a compelling choice for tech investors in 2026, supported by a Zacks Rank #1 (Strong Buy) and a consistent uptrend in EPS revisions. While a potential pullback could present an ideal entry opportunity, the increasing demand for NAND technology suggests further upside potential, especially considering SNDK’s reasonable valuation metrics.

Discover This Stock Now for Free >>

Access Free Stock Analysis on Sandisk Corporation (SNDK).

Get Free Stock Analysis on Western Digital Corporation (WDC).

This article was originally published on Zacks Investment Research (zacks.com).

Visit Zacks Investment Research for more financial insights.