Albany International (NYSE: AIN) is a global leader in advanced textiles and materials processing, catering to the paper and aerospace industries. With two key segments – Machine Clothing and Albany Engineered Composites – the company offers custom-designed fabrics for paper production and advanced materials for aerospace applications. Headquartered in Rochester, New Hampshire, Albany International is renowned for its innovation and manufacturing expertise.

Challenging Times for AIN Stock

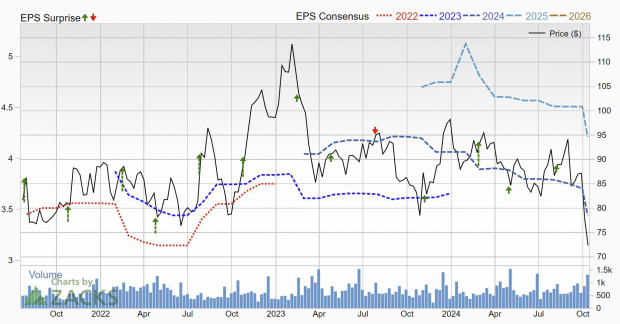

Albany International’s stock has faced difficulties recently, with flat earnings growth over the past five years and a decline in stock price. The company also received a Zacks Rank #5 (Strong Sell) rating from analysts, further impacting investor sentiment. Despite potential future appeal, the current setup suggests caution for investors.

Image Source: Zacks Investment Research

Earnings Outlook for AIN

Earnings estimates for Albany International have seen significant downward revisions, with current quarter estimates down by 34%. While earnings growth is expected to decline in the short term, a rebound is anticipated in FY25. Sales projections remain positive, indicating growth opportunities in the coming years.

Image Source: Zacks Investment Research

Technical Analysis: AIN Stock

Albany International’s stock price recently broke below a key support level, signaling bearish sentiment. Analyst downgrades have added pressure, indicating a potential further decline. Until a reversal in momentum occurs, a discounted valuation is expected.

Image Source: TradingView

Should Investors Consider AIN Stock?

Albany International’s challenges, including declining earnings and technical weakness, suggest a cautious approach for investors. With a “Strong Sell” rating and bearish market sentiment, waiting for signs of recovery may be prudent before considering an investment in AIN stock.

For more insights on potential investment opportunities, check out Zacks Investment Research’s free report on How To Profit From Trillions On Spending For Infrastructure.

Stay informed with the latest recommendations from Zacks Investment Research by downloading their free report on 5 Stocks Set to Double.

Find more details on Albany International Corporation (AIN) in the Free Stock Analysis Report.

Read the full article on Zacks.com here.

For more financial news and updates, visit Zacks Investment Research.

The Importance of Diversification in Investment Portfolios

Diversification is a key principle in investment management that aims to reduce risk by spreading investments across different asset classes, industries, and geographic regions. By not putting all your eggs in one basket, investors can protect themselves from significant losses if one investment performs poorly.

One of the main benefits of diversification is that it helps to mitigate the impact of market volatility. Different asset classes, such as stocks, bonds, and real estate, tend to react differently to market conditions. By holding a mix of these assets in a portfolio, investors can smooth out the ups and downs of individual investments and reduce overall risk.

Furthermore, diversification can also help investors capture returns from different market sectors. For example, if one sector is experiencing a downturn, investments in other sectors may be performing well, helping to offset losses. This can lead to more consistent returns over the long term.

In addition, diversification can also provide protection against unforeseen events that may impact a specific asset class or industry. For example, a global pandemic may have a devastating effect on certain sectors, such as travel and hospitality, while other sectors, such as technology and healthcare, may thrive. By diversifying across different sectors, investors can better weather unexpected events and protect their investments.

When it comes to building a diversified portfolio, investors should consider their risk tolerance, investment goals, and time horizon. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and possibly alternative investments such as commodities or precious metals. It is important to regularly review and rebalance a diversified portfolio to ensure that it remains aligned with one’s investment objectives.

In conclusion, diversification is a fundamental principle in investment management that can help investors reduce risk, capture returns from different sectors, and protect against unforeseen events. By building a well-diversified portfolio, investors can increase the likelihood of achieving their long-term financial goals.